The good news is that 2024 is not expected to be as bad as 2022 and 2023. The Fed has tamed inflation without sparking a recession and interest rate decreases are possible.

As for opportunity, AI - and especially generative AI - is still dominated by a few major companies - which is unlikely to change. Tech valuations remain high. China is going to be a tough market, particularly in an election year, but Europe offers possibilities. It is, in sum, not the worst of times, but probably not yet a return to the golden days of yore. JL

Theresa Hajer and colleagues report in Cambridge Associates:

The VC market will be a mixed bag in 2024. Among existing investments, valuations will decrease. AI will continue to serve as a major catalyst, supporting new investments, (but) deep-pocketed incumbents largely control generative AI. High-quality European turnaround and value should serve investors well. For China VC, US political rhetoric could deter some US and European investors from committing. In 2024, dry powder in the global secondaries market is projected to be $220 billion. The market will be driven by the substantial amount of dry powder, narrowing of the bid-ask spread and the continuing need for liquidity among LPs.We expect US venture capital down rounds will increase, even as artificial intelligence continues to serve as a major catalyst within the market. We believe flows to European turnaround and value strategies will increase and flows to China private investments will remain muted. We expect secondary transaction volume will increase to a record level.

Down Round US Venture Capital Financings Should Increase in 2024, Amid Rising AI-Investment Exuberance

Theresa Hajer, Head of US Venture Capital

Many aspects of the US venture capital (VC) market have corrected from their 2021 highs. But we expect the VC market will be a mixed bag in 2024. Among existing investments, we believe there will be an increase in “down rounds,” meaning valuations will decrease across financings. At the same time, we expect AI will continue to serve as a major market catalyst, supporting new investments and fund commitments.

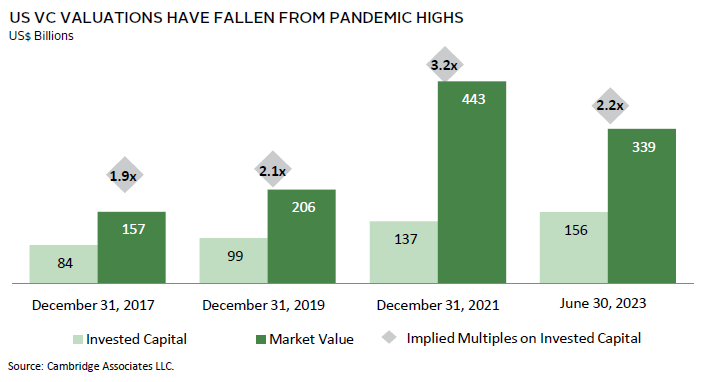

Low interest rates helped drive company formation and follow-on funding helped valuations rise to record highs through 2021. Since then, high interest rates and other macro factors have lessened market enthusiasm for technology start-ups. Later-stage valuations have fallen more sharply than those of early-stage companies, though both still exceed pre-2021 levels. According to Pitchbook, in 2023, the median change in valuation for follow-on financing rounds for early-stage companies was 1.7x, which is the lowest change in any year since 2016. Our US VC data tell a similar story, with implied multiples on invested capital falling since fourth quarter 2021. In 2022 and 2023, many start-ups curtailed spending and forewent growth to postpone raising capital. In 2024, with diminished or expired cash runways, we expect more companies seeking additional funding or liquidity to face down round valuations.

Despite this backdrop, the show will go on. The blistering fundraising in 2021 and 2022 means there is ample capital to fund transactions in 2024. Strong companies will have good prospects, but as investor appetite has waned, others may be consolidated, have their valuations reset, or simply shut down.

Right now, AI is consuming the venture community’s attention, which we believe will catalyze the market but maybe not as quickly as some expect. The field of AI is not new, but the seminal breakthrough of generative AI is, sparking fervor for opportunities in it. Deep-pocketed incumbents largely control the foundational layer of generative AI. Existing companies, including venture-backed ones, will continue to integrate AI tools to boost productivity and accelerate their businesses, while others may face obsolescence. Longer term, AI will drive disruptive innovation.

Capital Flows to Private European Turnaround and Value Strategies Should Increase in 2024

Petros Krappas, Senior Investment Director, Private Equity

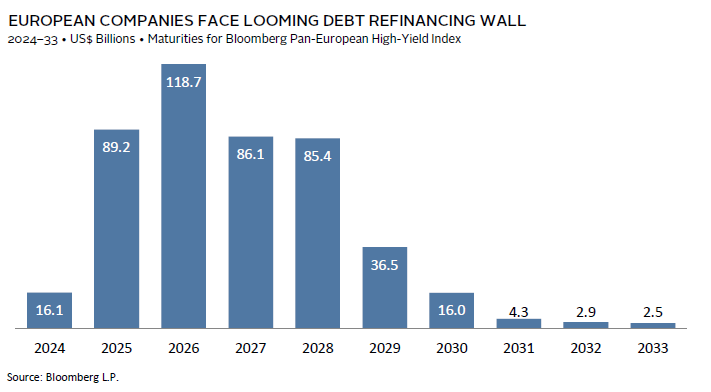

Until 2023, private investments had enjoyed a decade of buoyant markets, which favored growth-oriented strategies and put turnaround and value managers out of fashion. Fiscal and monetary stimulus as well as pandemic-related supply chain disruptions forced central banks to raise interest rates to address inflation. Many companies have yet to feel the full impact of the increased cost of capital as they accessed cheap debt packages during the more benign period leading up to 2023. Nonetheless, much of this debt will need to be refinanced in 2024 and 2025.

The inevitable increase in the cost of capital will put pressure on profitability, test businesses’ resilience, and likely increase insolvency rates. Conglomerates will continue to divest non-core subsidiaries, while public market dislocations could lead to more public-to-private transactions. We expect these market conditions will help flows to turnaround and value managers increase. Managers with large operating teams and restructuring expertise, differentiated networks of intermediaries, and connections with large corporates to secure carve out deal flow will have an advantage in this market, leading to attractive returns for managers deploying capital in 2024.

Investors with exposure to turnaround and/or value managers will benefit from the increased deployment we expect to see from these managers in 2024, partially offsetting the muted investment activity of the growth-oriented managers that are normalizing their deployment pace. This period of volatility should remind asset allocators that diversification is an essential ingredient of any private equity portfolio. This will boost the appetite for turnaround and value managers increasing the flow of new capital.

As always, manager selection is critical to success. Given the narrow universe of high-quality European turnaround and value managers, investors should remain disciplined and not invest with subpar managers simply to gain exposure. In our view, adding high-quality European turnaround and value exposure to portfolios in 2024 should serve investors well.

Foreign Capital Flows to China PE/VC Should Remain Muted in 2024

Aaron Costello, Regional Head for Asia, and Vivian Gan, Associate Investment Director, Capital Markets Research

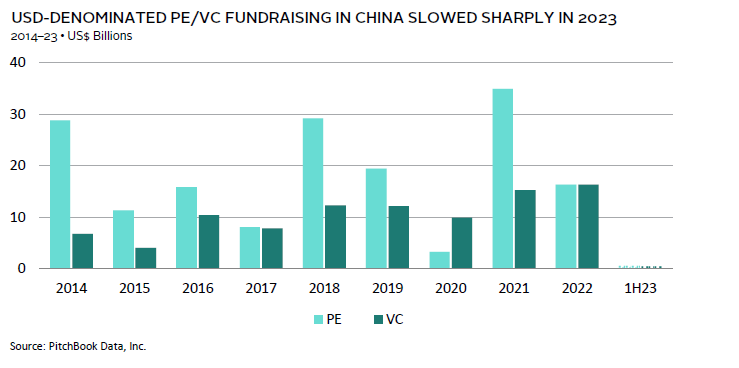

China USD-denominated private equity and venture capital (PE/VC) fundraising slowed dramatically in 2023, given US-China geopolitical tensions and pending US restrictions on advanced technology investments in China. On the latter, US President Biden’s August 2023 Executive Order (EO) limiting investments in advanced semiconductors, AI, and quantum computing in China has created uncertainty for US-linked GPs and LPs alike and impacted fund flows. Both GPs and LPs are awaiting clarity on how the measures will be implemented. The Treasury Department will take time to issue revised rules on the proposed program, which will be subject to further feedback and final approval. Therefore, clarity is unlikely until early 2024 at the earliest.

Even with the regulations finalized, GPs and LPs will need time to digest implications, and therefore fundraising in 2024 will likely remain muted. This is particularly the case for China VC, given the EO is focused on technology and potentially reduces the opportunity set for US-linked GPs and LPs. While China growth equity and buyouts may be more insulated, given their sectoral focus, US political rhetoric could deter some US and European investors from committing capital, especially in a US presidential election year. Lower capital commitments imply some non-US-linked GPs may also hold back fundraising, especially given broader headwinds to portfolio marks and exits.

Politics aside, attractive investment opportunities remain in China PE/VC, given China’s focus on technology self-sufficiency and other themes (e.g., consumption and healthcare). Non-US investors are likely to step in amid any pullback from US capital. However, overall foreign fund flows to the market will remain low in 2024 versus the annual average of $29 billion raised from 2014 to 2022, given uncertainty over how China’s progress in other technology areas (e.g., advanced manufacturing and green energy) will be impacted by the United States restricting access to high-end semiconductors and related technology. Yet, fewer capital-chasing deals may result in better opportunities for investors (US and non-US) willing to tolerate the uncertainty and headline risk.

Private Equity Secondary Transaction Volume Should Increase to a Record Level in 2024

Nicolas Schellenberg, Managing Director, Private Equity

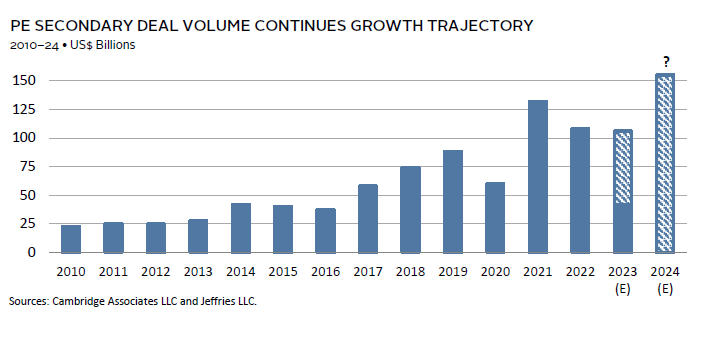

Private investment secondaries have experienced remarkable growth, peaking at a record of more than $130 billion in 2021. Although 2022 and 2023 did not reach the same heights, we anticipate a resurgence in 2024. This optimism is driven by several factors, including the substantial amount of dry powder, an expected narrowing of the bid-ask spread in secondaries, the continuing need for liquidity among LPs, and ongoing market innovation.

In 2022 and 2023, the secondary market witnessed large fundraisings, including record-breaking fund closings, which significantly boosted the amount of “dry powder” capital available for new investments. As we enter 2024, dry powder in the global secondaries market is projected to be around $220 billion (1.7x–2.2x recent transaction volume).

Pricing will experience modest increases, with average discounts around 10%. However, these pricing improvements—particularly in high-quality assets—are expected to pique the interest of sellers seeking liquidity. At the same time, valuation adjustments by GPs will reduce the bid-ask spread, facilitating more transactions. And, sellers are becoming increasingly comfortable with discounts, weighing them against the opportunity costs of not reinvesting in crucial manager relationships. Returning to a higher employment of debt by buyers may further bridge the bid-ask spread, facilitating additional transactions and bolstering available capital for secondaries.

The GP-led market, though not new, is often viewed as innovative due to its recent growth. Its growth has been propelled by GPs seeking liquidity solutions for their LPs in a challenging exit landscape. Secondary buyers are also becoming more creative to unlock transactions, and we have observed a rise in the implementation of inventive strategies and structured approaches, including preferred equity solutions and deferred payments. We expect a promising future for private investment secondaries, marked by growth to a new record transaction volume in 2024.

Figure Notes

US VC Valuations Have Fallen From Pandemic Highs

Based on the total current cost and market value of unrealized investments made by venture capital funds as of each date.

USD-Denominated PE/VC Fundraising in China Slowed Sharply in 2023

Data have not been reviewed by PitchBook analysts. PE represents buyouts and growth equity.

PE Secondary Deal Volume Continues Growth Trajectory

Data for 2023 are through June 30. Data from June 30, 2023 through 2024 are estimates.

0 comments:

Post a Comment