Venture investors remain concerned about the impact of inflation on global markets and the prospects for entrepreneurial companies. JL

Ali Naqvi and Annie Sabater report in S&P Global:

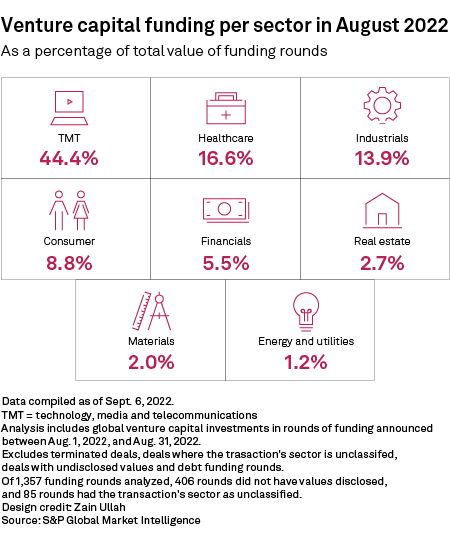

The value of global venture capital-backed funding rounds fell 57.7% year over year in August to $21.31 billion, while the number of transactions was down 24.2%. The technology, media and telecommunications sector accounted for the largest share of the capital raised in August at 44.4%, followed by the healthcare and industrial sectors at 16.6% and 13.9%, respectively.The value of global venture capital-backed funding rounds fell 57.7% year over year in August to $21.31 billion, while the number of transactions was down 24.2%, according to S&P Global Market Intelligence data.

The year-over-year values have continued to decline in recent months. The amount raised in August was also slightly lower than July, when $21.78 billion was pulled in, the data shows.

Companies based in Asia-Pacific received $9.1 billion across 554 funding rounds. U.S. and Canadian companies drew $8.7 billion across 476 transactions, while Europe secured $2.0 billion in 234 funding rounds.

TMT industry remains top target

The technology, media and telecommunications sector accounted for the largest share of the capital raised in August at 44.4%, followed by the healthcare and industrial sectors at 16.6% and 13.9%, respectively.

Top financing rounds

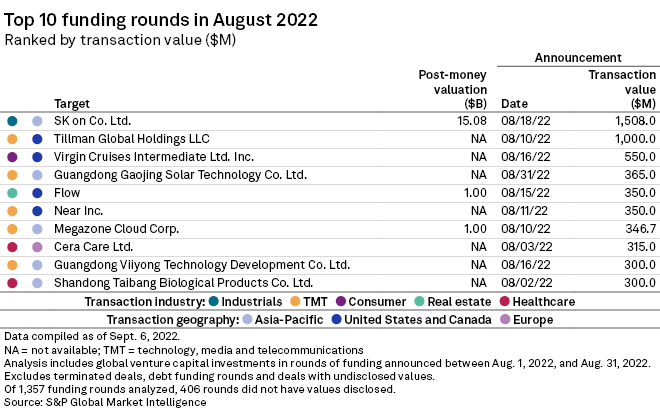

The largest funding round in August was for South Korean electric vehicle battery manufacturer SK on Co. Ltd., which raised roughly $1.51 billion. Korea Investment Private Equity, Stella Investment and East Bridge Partners Co. Ltd. were the investors in the round.

Next up was New York-based Tillman Global Holdings LLC, a privately held cell tower platform in the U.S., which secured $1 billion from The Carlyle Group Inc.'s fund Carlyle Global Infrastructure Opportunity Fund LP in a mature funding round.

Cruise ship operator Virgin Cruises Intermediate Ltd. Inc. held the third spot, raising $550 million in a funding round led by BlackRock Investment Management (UK) Ltd. Other backers included Bain Capital Pvt. Equity LP.

0 comments:

Post a Comment