Let's just say it's more of a risk now than it has been since the beginning of vaccinations. JL

Barry Ritholtz reports in The Big Picture:

Since the market crash in 2020, I have been steadfastly bullish on, well, everything: The economy, the vaccines, and of course the markets. The pandemic was an externality that caused markets to wobble but it did not end the secular bull market. Are we going to risk this entire hard-won progress? Are we going to allow millions more to get infected, 1,000s of children die? When the economy returns to its fetal position, when the market gets punched in the throat, do not, under any circumstances, make the claim that “No one could see it coming.”

People, people, people: What must I do to get your attention?

Let’s try this:

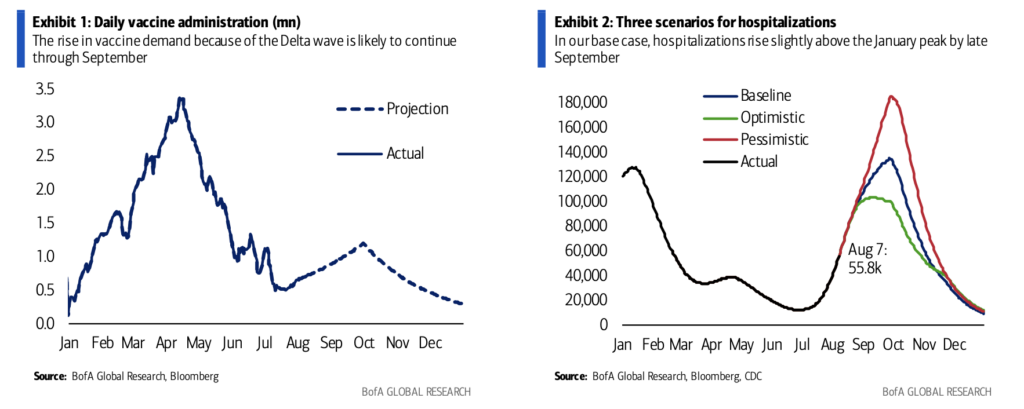

If we do not radically improve our Vaxx rates ASAP, the entire economic recovery and precariously positioned, somewhat expensive market is put at risk of a 20-30% crash. This one will not have the trillion-dollar stimulus and rapid recovery of the 2020 edition, but rather, will be long, slow, and painful.

Are you paying attention yet?

The threat has been apparent for a while now and I have to admit being perplexed by the soft response from the Biden Admin, and the milquetoast leadership from the Corporate sector.

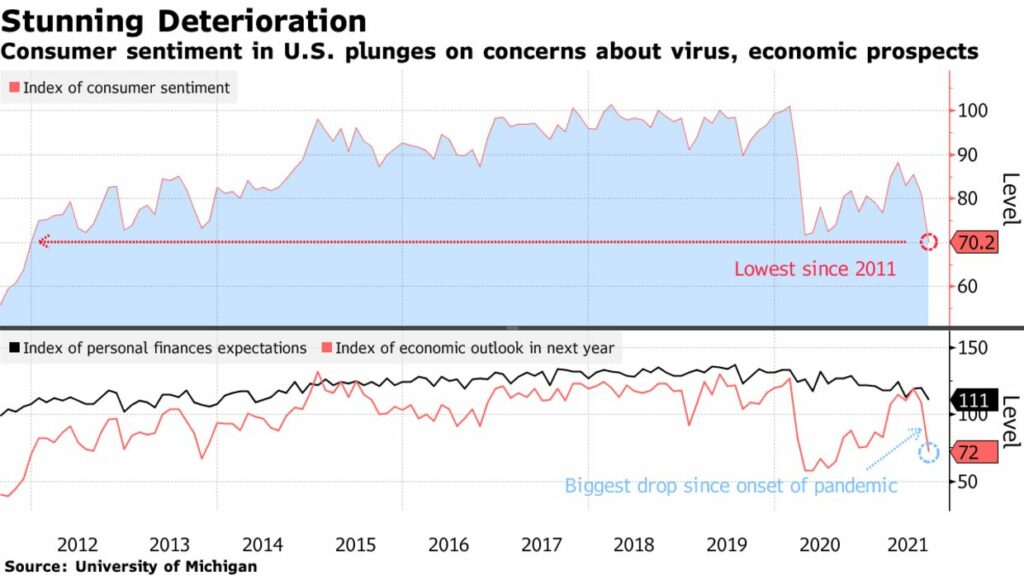

Are we really going to just ignore the worst Consumer Sentiment numbers in a decade?

We solved for Covid in a record time, and we are about to use artificial antibodies to beat malaria. Can we please do everything possible to use our scientific expertise to get past this pandemic?

~~~

Since the market crash in 2020, I have been steadfastly bullish on, well, everything: The economy, the vaccines, and of course the markets. The pandemic was an externality that caused markets to wobble but it did not end the secular bull market.

But I was at DEFCON 5 in 2006, DEFCON 3 most of 2007, and I went to DEFCON 1 Jan 1, 2008.

Are we going to risk this entire hard-won progress? Are we going to allow millions more to get infected, 1,000s of children die? When the economy returns to its fetal position, when the market gets punched in the throat, do not, under any circumstances, make the claim that “No one could see it coming.”

We are now at DEFCON 3. When a true and new market risk is identified, it is in your self-interest to pay attention.

0 comments:

Post a Comment