But from the standpoint of behavioral economics, when almost half the world's population is quarantined and many are out of work, basics take precedence. JL

Jamie Powell reports in FT Alphaville:

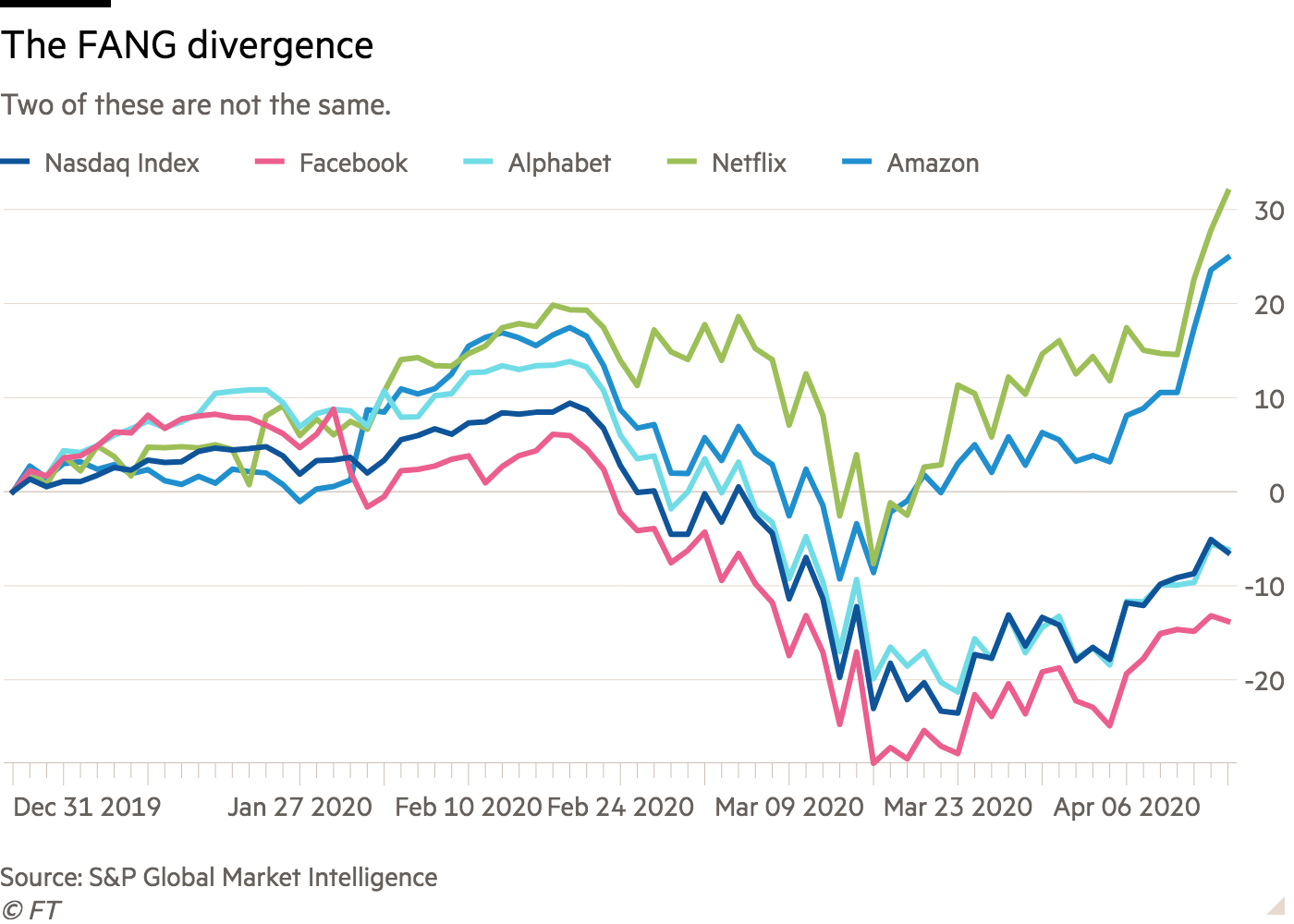

The FANG stocks (Facebook, Amazon, Netflix and Google) have diverged. Netflix and Amazon have split from their compatriots due to their business models being suited to a stay-at-home driven economic shock. For all their attempts to diversify their business models, Facebook and Google still collect the vast majority of their revenues from advertising. "We are lowering 2021 revenue estimates by -12.5% for Facebook and -10% for Alphabet. Given the high fixed-cost nature to their business models, we project even steeper 2021 EBITDA declines in the range of -20 per cent."

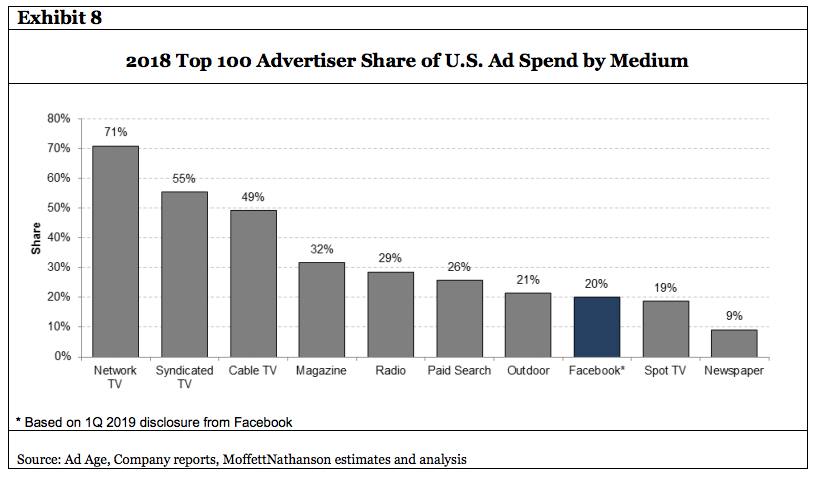

In the market sell-off during the coronavirus crisis, the fabled FANG stocks (that’s Facebook, Amazon, Netflix and Google) have diverged. Netflix and Amazon have split from their compatriots due to their business models being uniquely suited to a stay-at-home driven economic shock:The divergence is a reminder that, for all their attempts to diversify their business models -- whether it be in cloud computing or digital currencies -- Facebook and Google still collect the vast majority of their revenues from advertising. A market which historically has been highly cyclical.Out Thursday was a new note from research shop MoffettNathanson highlights this, and accordingly, the team have revised their revenue and earnings estimates down for the two businesses across both 2020 and 2021:Although Alphabet and Facebook may seem like safe places to hide given their market dominance and strong balance sheets, we believe they are not immune from worsening ad trends, especially given their exposure to the long tail of SMBs. We believe Twitter and Snap are even more at risk from marketers consolidating budgets towards the core ad platforms and away from more experimental/fringe ad buys during this crisis.Using recent survey data from the IAB, we are projecting ad growth to decelerate by a staggering -2,600 bps to -2,700 bps for Alphabet and Facebook over the next two quarters. This would be a faster and steeper drop than the -2,100 bps decline in digital ad growth during the 2008-09 financial crisis. We do not anticipate ad growth to get back on trend to normalised levels until 2Q 2021 when these platforms begin to lap the 2020 declines.Importantly, we are not projecting a sharp catch up in ad spending in 2021 to make up for lost revenues in 2020. The 2020 budgets that have been gutted are gone and won’t miraculously return in the future. Accordingly, we are lowering our 2021 revenue estimates by -12.5 per cent for Facebook and -10 per cent for Alphabet. Given the high fixed-cost nature to their business models, we project even steeper 2021 EBITDA declines in the range of -20 per cent.The report is worth reading in whole, so do get in touch with the team if you’re interested. But this chart really drew our attention to just how tethered Facebook’s revenues are to SME advertising spending, versus the traditional means of reaching consumers:It’s not just the SMEs turning off the advertising costs either. Barry Diller, chairman of $8bn online travel company Expedia, told CNBC earlier on Thursday that it normally spends $5bn on ads, but probably “won’t spend $1bn this year”.Such anecdata might not translate to the wider advertising market but, if it does, it’s fair to say that even MoffettNathanson’s plunging estimates may be a touch too optimistic.

0 comments:

Post a Comment