Robert Klara reports in Ad Week:

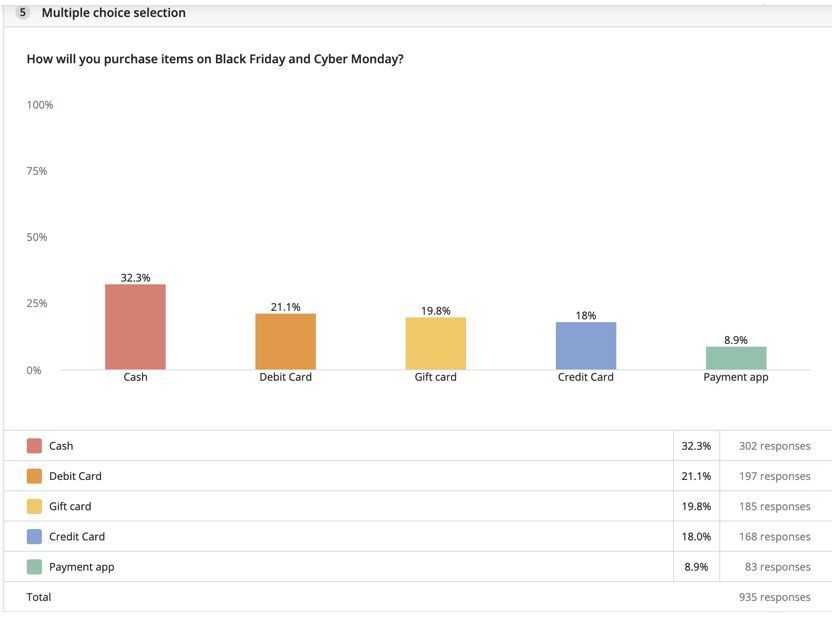

Of millions of under-24 Americans on Black Friday and Cyber Monday, 32% will opt for paper currency to pay. 47% report they will troop to the mall or to standalone stores to do their shopping. As Gen Z witnesses the load of student debt that’s saddled millennials, they fear winding up in the same boat. By using cash, they’re not creating debt. Since many members of Gen Z are not yet old enough to earn wages, much of Gen Z is paid in cash. Another reason for cash is data privacy. Cash transactions leave no electronic footprints

It’s an article of faith among marketers that members of Gen Z (the age cohort that’s now between 4 and 24 years old) are digitally savvy. They are “tech natives,” we’re told. It’s even said that millennials (whom we were hailing as digital natives only yesterday) are now asking Gen-Z for tech help.

This “most web-savvy, app-friendly generation,” as CBS News has termed them, spend over 15 hours a week on their smartphones. Epsilon’s data shows that three-quarters of Gen Z consumers use their smartphones to shop online. It follows that roughly the same majority (70%, according to the financial brand) have signed up for mobile banking apps.

So here’s something to chew on. As 74 million Gen Z consumers march off to do their holiday shopping this Black Friday, many of them will be paying not with electronic transfers or banking apps, but with cash. You know, the paper stuff.

.

According to a just-released Brainly survey of 1,500 Gen Z consumers, of millions of under-24 Americans that’ll be looking for gifts on Black Friday and Cyber Monday, just over 32% of them will opt for paper currency to pay for them.Survey finds some Gen Zers prefer using cash.Courtesy: Brainly

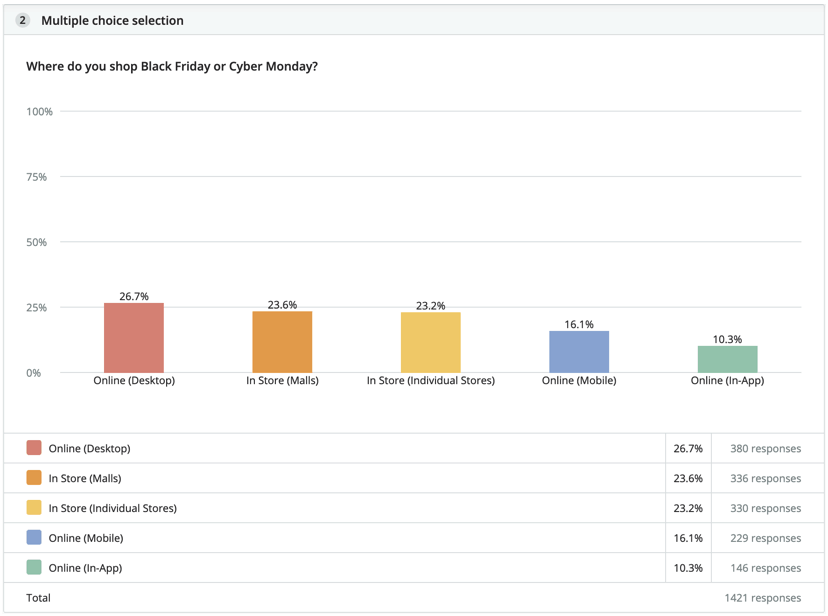

Brainly also found that a surprising number of Gen Zers will also be heading for brick-and-mortar stores on both days, with nearly 47% reporting that they will troop off to the mall or to standalone stores to do their shopping.

What’s going on? Is the prevailing data about this digitally driven generation incorrect? Well, no. But the presumption that young consumers have left traditional methods of shopping and paying behind turns out to be premature. As it turns out, there are many reasons why Gen-Z likes to pay with cash—and one of the biggest ones is Gen-Y, otherwise known as the millennials.

Today’s youngest consumers have “learned a lot from the generation above them,” said Brainly’s vp of sales Bill Drolet. As Gen Z witnesses the crushing load of student debt that’s saddled millennials, they fear winding up in the same boat. “There are so many ads [about] trying to solve the millennial debt [problem], and they’re very aware of that,” he said. “And by using cash, they’re not creating debt.”

Drolet added that since many members of Gen Z are not yet old enough to earn wages in the traditional, taxed economy—working instead doing odd jobs like yard work and babysitting—much of Gen Z is paid in cash anyway. In fact, for many young people, paper currency stuffed into a piggy bank is still a way of life. According to the FDIC data from 2017, 10% of Americans between the ages of 15 and 24 have no bank account.

Another likely reason for the choice of cash is anxiety about data privacy. Cash transactions, after all, leave no electronic footprints behind them. While baby boomers and Gen X generally exhibit higher rates of discomfort about online security and the use of their personal information online, that’s hardly to suggest that younger consumers aren’t proportionally worried.

In fact, a survey released by Factual earlier this year found that, when asked if they’re “concerned about data privacy,” Gen Z respondents had more misgivings than their millennial counterparts: 53% of Gen-Z Americans said they were somewhat or very concerned versus 51% of Gen-Y respondents. Gen-Z, said Brainly’s Drolet, is “very aware of the privacy [issue] because of their affiliation with all of these apps, and hearing about the security [breaches] out there.”

If Gen-\ Z is still enamored with paying in cash, it only follows that they also tend to like retail settings that enable them to do that—the brick and mortar store. According to Brainly’s findings, the leading destination for buying electronics on Black Friday isn’t Amazon, but Walmart—though by a very thin margin of .1% Asked to list the big-box stores they plan to visit, Walmart came in first (16.5%), followed by Target (14.1%) then Macy’s and Kohl’s (9.7% and 8.6%, respectively.)

0 comments:

Post a Comment