Well what do you know; millennials care about value, convenience and service, just like other humans. High tech or not. Marketers take note. JL

Robert Klara reports in Ad Week:

Millennials may well be more socially aware and politically progressive that older generations, but, they appear to behave like everyone else when it comes to spending money. That means: Ethics are good, but price and convenience carry the day.

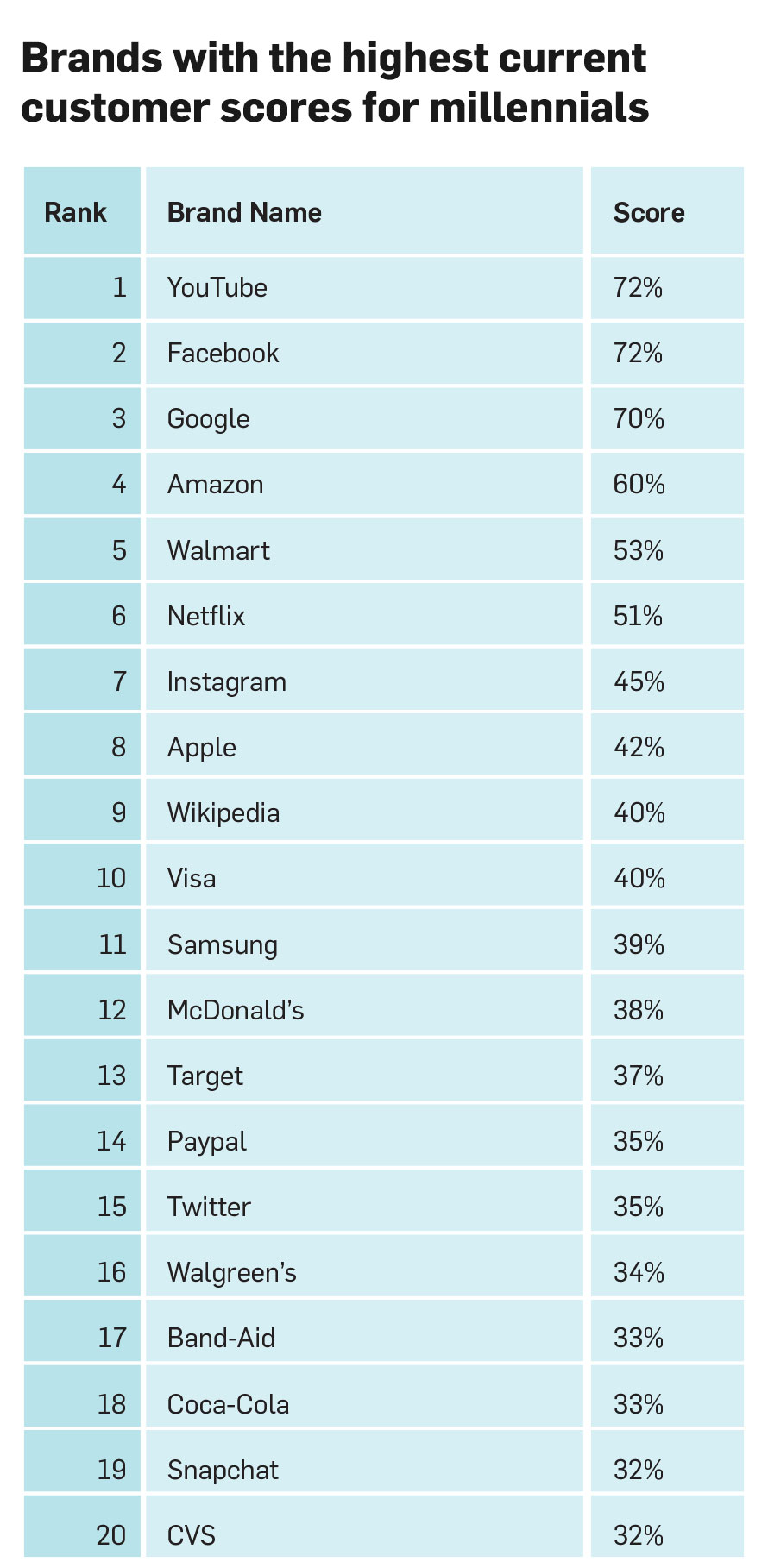

It’s probably no surprise that millennial consumers tend to spend their time and money with big digital brands. After all, many in this age cohort (now somewhere between 18 and 29 years old) were hitting their teens right around the time that today’s online Goliaths were grabbing their first market share. So it follows that the results of a new study of brands favored by Gen-Y consumers, released today, is chock full of familiar names.

Letting Uber off easy

Occupying the No. 1 spot in terms of improved brand standing is the much-beleaguered and possibly unforgivable Uber, which grew its millennial customer base an astonishing 8.2 percent points this year over last. This growth came despite a pretty much uninterrupted flow of alarming news about the $70 billion ride-sharing app, and calls into question millennials’ much-ballyhooed moral and ethical compass, at least when it comes to how they spend their money.

Granted, YouGov’s survey, which compared attitudes in the first six months of 2017 with those in the first half of last year, concluded before the latest headline out of San Francisco: founder Travis Kalanick is finally stepping down from the CEO post last month. Even so, allegations of Uber’s corporate and moral turpitude stretch back a good many years—far too long for the average media-savvy millennial to have failed to hear about them.

Another surprise: Despite financial-services firms having taken a righteous beating in the years after the 2008 economic meltdown—an event that hit many millennials just as they were entering the job market—those firms still ranked surprisingly high in YouGov’s list. Chase and JPMorgan occupy the No. 13 and 14 slots, respectively, having made gains of 2.8 and 2.7 percent points in making millennials into regular customers.

So what gives? Has Gen-Y abandoned its scruples? Well, not exactly.

Millennials may well be more socially aware and politically progressive that older generations, but according to YouGov BrandIndex CEO Ted Marzilli, they appear to behave like everyone else when it comes to spending money. That means: Ethics are good, but price and convenience carry the day. Which suggests that whatever hard feelings young people may harbor against Chase are probably secondary to the convenience of online banking or the ease of finding an ATM nearby. And the same maxim applies to finding a car service home from the bar

“I’m not saying millennials are not concerned about ethics,” Marzilli said. “But people in the aggregate tend to make choices that are in their financial interests. So if taking Uber is more economical or convenient than waiting for a cab, I’m probably still going to call Uber.”

Reverence for your elders

Another surprise in the YouGov ranking is that fully half of these millennially-beloved brands are companies that were around before there even was an internet, among them Puma and Ace Hardware. It’s a powerful retort to the presumptive irrelevance of legacy companies, and offers proof that twentysomething consumers have plenty of love left for the brands of yesteryear.

“It no longer surprises me that when we do these rankings … there is often a reasonably balanced mix of new brands and traditional brands—I don’t think traditional brands are all going away or will be out of business,” said Marzilli, explaining the presence of brands such as Delta airlines, Adidas and Visa, which posted gains in millennial customers of 3.8 percent, 3.4 percent, and 3.2 percent points, respectively, in the first six months of 2017 compared to the same period last year.

But there’s a catch. YouGov’s findings make clear that these graybeards aren’t popular with millennials so much for their nostalgic value as their ability to adapt and stay current.

“The existence of brands on this list that weren’t around 10 or 15 years ago suggests that, for millennials, the most important thing is that the brand is relevant and resonates with any consumer group,” Marzilli said. “So if the brand doesn’t provide the value, it doesn’t matter.”

For instance, there’s TLC, which ranks at No. 5, having grown its millennial customers by 4.7 percent points. The Discovery Communications network’s roots reach back to the early 1970s, when it was an education-oriented channel co-founded by the Department of Health, Education and Welfare and NASA. And while some have lamented TLC’s devolution from The Learning Channel to the home of Honey Boo Boo and shows like “My Fat Saved My Life,” the bottom line is that TLC has survived by keeping up (or down) with the times.

“We may think about [TLC] as being old media,” Marzilli said, “but with so many old-media [channels] offering on-demand, they’re participating in the new-media economy as well.”

Similarly, a brand like Visa—a name chosen in 1976 for the international version of the Bank of America’s first international credit card—is no longer just that plastic thing you keep in your purse or wallet. “They now have [the online payment system] Visa Checkout, so it’s lending itself to more of a millennial mindset and lifestyle,” Marzilli said. Visa holds the No. 10 slot of YouGov’s list, having built is millennial customer base by 3.2 percent points over the last year.

Always remember to share

On the other side of the coin, the presence of companies like Instagram, WhatsApp and Spotify serves as a predictable nod to the prevailing wisdom that twentysomethings devote much of their day (by some accounts, as much as 10 hours of it) to their screens. Indeed, a subset of this group speaks volumes about yet another millennial preference. Apart from the aforementioned Uber in the lead position, occupying the No. 3 and 12 spots, respectively, are Lyft and Airbnb—together, they are the holy trinity of the sharing economy.

As Marzilli points out, the popularity of such sites is hardly exclusive to the younger demographic (Airbnb recently reported that people age 60 and older make up the fastest-growing demographic of its hosts, and the average user is 35 years old)—but their place on the survey confirms that younger consumers have a high comfort level with sharing platforms.

That said, the dominance of these brands in the millennial constellation does call up the question of long-term viability, at least to Marzilli. “One of the challenges to those brands is, as people mature, [will] they stay with them and stay comfortable with that idea over time?” he said. “Or do those brands become something ‘I used to do when I was younger.’?”

YouGov’s survey tucks another head-scratcher near the bottom of the list. Right next to No. 19 ranked Indeed.com (whose 2.2 percent growth in millennial customers suggests that young people are just as career savvy as ever) is the Bellagio—the Las Vegas resort whose casino pulled in some $600 million last year.

Marzilli said he has no ready explanation for why the flashy casino was able to boost its twentysomething customers by 2.1 percent points. A study released last year by Stockton University’s Lloyd D. Levenson Institute of Gaming, Hospitality & Tourism revealed that, overall, millennials don’t like to gamble.

So what could it be? Possibly the residency of Ricky Martin? Maybe. But that 1990s superstar is now 45—an oldies act by millennial standards.

YouGov BrandIndex, a public-perception research firm that interviews over 1.5 million consumers yearly, just unveiled the results of its latest survey, which ranks the brands that notched the biggest gains in making millennial consumers into current customers. As one might expect, the ranking of 20 companies is heavy with digital heavy hitters like like Twitter, Snapchat and Airbnb. Each brand’s customer score is the percentage of U.S. millennials who are current customers of that particular brand. Current customer means they bought the product or visited the web site within the past 30 days.

Even so, dismissing this list as yet another confirmation of tired assumptions about millennial tastes would be a mistake: Lurking between and among the usual suspects on this ranking are a few genuine surprises. And foremost among them is right at the top.

Letting Uber off easy

Occupying the No. 1 spot in terms of improved brand standing is the much-beleaguered and possibly unforgivable Uber, which grew its millennial customer base an astonishing 8.2 percent points this year over last. This growth came despite a pretty much uninterrupted flow of alarming news about the $70 billion ride-sharing app, and calls into question millennials’ much-ballyhooed moral and ethical compass, at least when it comes to how they spend their money.

Granted, YouGov’s survey, which compared attitudes in the first six months of 2017 with those in the first half of last year, concluded before the latest headline out of San Francisco: founder Travis Kalanick is finally stepping down from the CEO post last month. Even so, allegations of Uber’s corporate and moral turpitude stretch back a good many years—far too long for the average media-savvy millennial to have failed to hear about them.

Another surprise: Despite financial-services firms having taken a righteous beating in the years after the 2008 economic meltdown—an event that hit many millennials just as they were entering the job market—those firms still ranked surprisingly high in YouGov’s list. Chase and JPMorgan occupy the No. 13 and 14 slots, respectively, having made gains of 2.8 and 2.7 percent points in making millennials into regular customers.

So what gives? Has Gen-Y abandoned its scruples? Well, not exactly.

Millennials may well be more socially aware and politically progressive that older generations, but according to YouGov BrandIndex CEO Ted Marzilli, they appear to behave like everyone else when it comes to spending money. That means: Ethics are good, but price and convenience carry the day. Which suggests that whatever hard feelings young people may harbor against Chase are probably secondary to the convenience of online banking or the ease of finding an ATM nearby. And the same maxim applies to finding a car service home from the bar

“I’m not saying millennials are not concerned about ethics,” Marzilli said. “But people in the aggregate tend to make choices that are in their financial interests. So if taking Uber is more economical or convenient than waiting for a cab, I’m probably still going to call Uber.”

Reverence for your elders

Another surprise in the YouGov ranking is that fully half of these millennially-beloved brands are companies that were around before there even was an internet, among them Puma and Ace Hardware. It’s a powerful retort to the presumptive irrelevance of legacy companies, and offers proof that twentysomething consumers have plenty of love left for the brands of yesteryear.

“It no longer surprises me that when we do these rankings … there is often a reasonably balanced mix of new brands and traditional brands—I don’t think traditional brands are all going away or will be out of business,” said Marzilli, explaining the presence of brands such as Delta airlines, Adidas and Visa, which posted gains in millennial customers of 3.8 percent, 3.4 percent, and 3.2 percent points, respectively, in the first six months of 2017 compared to the same period last year.

But there’s a catch. YouGov’s findings make clear that these graybeards aren’t popular with millennials so much for their nostalgic value as their ability to adapt and stay current.

“The existence of brands on this list that weren’t around 10 or 15 years ago suggests that, for millennials, the most important thing is that the brand is relevant and resonates with any consumer group,” Marzilli said. “So if the brand doesn’t provide the value, it doesn’t matter.”

For instance, there’s TLC, which ranks at No. 5, having grown its millennial customers by 4.7 percent points. The Discovery Communications network’s roots reach back to the early 1970s, when it was an education-oriented channel co-founded by the Department of Health, Education and Welfare and NASA. And while some have lamented TLC’s devolution from The Learning Channel to the home of Honey Boo Boo and shows like “My Fat Saved My Life,” the bottom line is that TLC has survived by keeping up (or down) with the times.

“We may think about [TLC] as being old media,” Marzilli said, “but with so many old-media [channels] offering on-demand, they’re participating in the new-media economy as well.”

Similarly, a brand like Visa—a name chosen in 1976 for the international version of the Bank of America’s first international credit card—is no longer just that plastic thing you keep in your purse or wallet. “They now have [the online payment system] Visa Checkout, so it’s lending itself to more of a millennial mindset and lifestyle,” Marzilli said. Visa holds the No. 10 slot of YouGov’s list, having built is millennial customer base by 3.2 percent points over the last year.

Always remember to share

On the other side of the coin, the presence of companies like Instagram, WhatsApp and Spotify serves as a predictable nod to the prevailing wisdom that twentysomethings devote much of their day (by some accounts, as much as 10 hours of it) to their screens. Indeed, a subset of this group speaks volumes about yet another millennial preference. Apart from the aforementioned Uber in the lead position, occupying the No. 3 and 12 spots, respectively, are Lyft and Airbnb—together, they are the holy trinity of the sharing economy.

As Marzilli points out, the popularity of such sites is hardly exclusive to the younger demographic (Airbnb recently reported that people age 60 and older make up the fastest-growing demographic of its hosts, and the average user is 35 years old)—but their place on the survey confirms that younger consumers have a high comfort level with sharing platforms.

That said, the dominance of these brands in the millennial constellation does call up the question of long-term viability, at least to Marzilli. “One of the challenges to those brands is, as people mature, [will] they stay with them and stay comfortable with that idea over time?” he said. “Or do those brands become something ‘I used to do when I was younger.’?”

YouGov’s survey tucks another head-scratcher near the bottom of the list. Right next to No. 19 ranked Indeed.com (whose 2.2 percent growth in millennial customers suggests that young people are just as career savvy as ever) is the Bellagio—the Las Vegas resort whose casino pulled in some $600 million last year.

Marzilli said he has no ready explanation for why the flashy casino was able to boost its twentysomething customers by 2.1 percent points. A study released last year by Stockton University’s Lloyd D. Levenson Institute of Gaming, Hospitality & Tourism revealed that, overall, millennials don’t like to gamble.

So what could it be? Possibly the residency of Ricky Martin? Maybe. But that 1990s superstar is now 45—an oldies act by millennial standards.

0 comments:

Post a Comment