Private label goods typically undersell competing branded products, but more of the margins go to label owner, in this case, Amazon. Which means it not only owns the distribution channel, it owns what flows through it to the consumer.

And, as the following article explains, the target customers are Millennials who are less focused on the end product than on who gets them there (or gets it to them) cheapest, fastest, most conveniently and with the highest quality available. JL

Elizabeth Wiese and Eli Blumenthal report in USA Today:

The generation that's grown up with the Internet has shown more loyalty to distributors — say flight-and hotel-aggregator Kayak.com or delivery services Uber Eats — than the end brand that provides the good or service. Amazon already “owns” the customers' loyalty and trustt. The private label means the item is likely to be cheaper — a draw for America's largest living generation.“Millennials care about quality and price and taste; they’re brand agnostic."

Amazon's reported shift into private label grocery offerings takes a page out the basic retail strategy book it's aggressively pursued, often to the chagrin of brick-and-mortar competitors.

But Amazon has an even bigger incentive than Target and Wal-Mart did when they expanded into private-label products over a decade ago: Millennials.

The generation that's grown up with the Internet has shown more loyalty to distributors — say flight-and hotel-aggregator Kayak.com or delivery services Uber Eats — than the end brand that provides the good or service, says Phil Lempert, a Los Angeles-based consumer analyst who focuses on food trends.

In the case of an Amazon-branded coffee or detergent, Amazon already “owns” the customers' loyalty and trust, which means its own name carries weight, says Lempert. The private label means the item is likely to be cheaper — a draw for America's largest living generation, who are now in their 20s and early 30s.“Millennials care about quality and price and taste; they’re brand agnostic. It's a sweet spot for Amazon,” he said.

Along with detergent and diapers, the Seattle-based online retailer plans to sell private label nuts, spices, tea, coffee, baby food and vitamins, according to a report in the Wall Street Journal. Amazon would not comment on the report.

The product expansion can help Amazon continue to be the go-to choice for the connected generation, as well as reshape consumer perception about where they can go to get the things they need every day, according to Market Track, a Chicago-based market analysis firm. That's something that traditionally happened in brick-and-mortar stores but which Amazon wants to move online.

Private labels popular

The move is not completely foreign to Amazon, which already sells electronics accessories and home goods such as bed sheets and knife sets under its Amazon Basics brand.

It's had some missteps in the past. In late 2014, it dabbled in private label grocery items, including baby diapers bundled with wipes called Amazon Elements. Unlike its Amazon Basics label, Elements did not catch on with consumers and the company cancelled the product after customer complaints around a month after launch.

In the grocery world, private label brands are a big money maker. The items are often produced in the same plants as name- brand items but are labeled with a store brand, saving all the cost of advertising and thus allowing them to be sold for less.

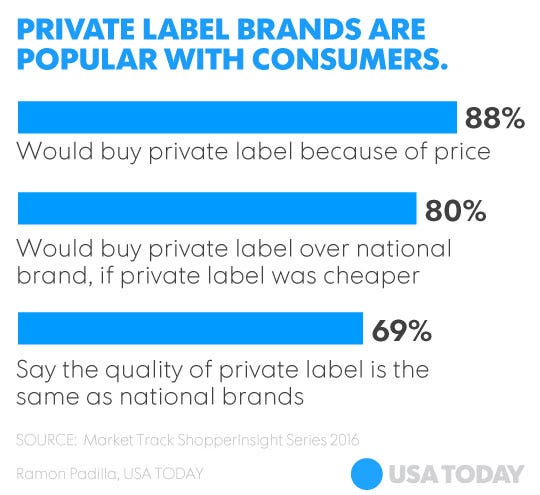

A full 88% of consumers say they buy private label, primarily because of price, according to Market Track. If they have to make a decision between a private label and a national brand, and the private label brand has a lower price, they go for the the private label at a rate of 80%, the firm's survey's show.

“Due to Amazon’s size and scale they have the ability to offer pricing that is highly competitive,” said Traci Gregorski, vice president of marketing at Market Track.

All about the Prime

The products will be available only to Amazon Prime members, according to the Wall Street Journal. Members pay $99 a year for two-day delivery, free streaming video and a host of other extras. The build-out is part of Amazon’s long-term plan to further pull Americans into its retail world with Prime membership.

“The entire Amazon ecosystem revolves around Prime,” said David Smith, an Amazon analyst with Gartner.

That's because Prime members are so lucrative. They spend on average about $1,100 per year, compared with about $600 per year for non-members, according to Consumer Intelligence Research Partners.

There were 54 million Prime members in the United States at the end of 2015, 21% of the U.S. adult population, a CIRP report from January found.

Amazon itself doesn't disclose Prime membership numbers, beyond saying it has tens of millions of Prime members.

The move shouldn’t have come as a surprise to anyone in the grocery business, where house brands are part of the playbook of every major retail account. They look at what sells and then produce it on their own for higher margins, said Sucharita Mulpuru, a senior Amazon analyst with Forrester.

“It's not like this is as complex as flying to Mars. This is what the club warehouses and Trader Joe's do all day,” she said.

A miss on the names

Some of the brand names Amazon may use for its new lines include Happy Belly, Wickedly Prime, Presto! and Mama Bear, according to the Journal report.

Happy Belly would be the brand for nuts, spices, tea and cooking oil. Wickedly Prime will be the name for snacks, while Mama Bear would be the name used for baby food and diapers. Detergents and home goods would fall under the Presto! name.

If those are the names, it's a stumble on Amazon's part, Lempert said.

“"They’re weird, they’re trying to to be too hip and cool,” he said.

0 comments:

Post a Comment