The Economist reports:

Ten years ago Americans visited five dealers before making a purchase but now they visit 1.6 on average. What motorists do want is someone to talk them through all the features that cars come with these days—entertainment systems, navigation services, automated parking...

THE internet was supposed to do away with all sorts of middlemen. Yet house sales are mostly conducted by estate agents, and car sales are still finalised in cavernous showrooms that smell of tyres. Technology is diminishing the role of car dealers, however. Customers are using the internet for much of the process of choosing a new car, and are increasingly getting loans and insurance online rather than buying them from the dealer who sells them their car. Some carmakers are seeking ways to bypass dealers too.

In the motor industry’s early days, a century ago, manufacturers tried selling their vehicles at the factory gate, in shops they owned themselves, by mail order and through travelling salesmen. But eventually they settled on a system of franchising, in which independent dealers mostly sell just one maker’s models. Now, almost all of the 90m motor vehicles sold worldwide each year cross dealers’ forecourts. In America, the second-largest car market, their total revenues reached $806 billion in 2014. China’s car market, the largest, has rapidly come to resemble the West’s, with all its faults (see article).

Surveys show that car buyers find the experience of visiting a dealer boring, confrontational and bureaucratic, notes Nick Gill of Capgemini, a consulting firm. No wonder they try to avoid them. Ten years ago Americans visited five dealers before making a purchase, according to McKinsey, another consulting outfit, but now they visit 1.6 on average. The trend is similar elsewhere in the world. In many cases car buyers turn up having already decided which model and which options they require; and, having checked price-comparison websites, how much they will pay. Almost all cars these days have decent performance and handling, so test drives are less important than ever. Styling and branding—things that can be assessed without visiting a dealer—figure more prominently in buyers’ minds. The role of traditional car salesmen, geared for the hard sell, is waning.

What motorists do want, though, is someone to talk them through all the features that cars come with these days—entertainment systems, navigation services, automated parking and so on. Carmakers are beginning to respond. Since 2013 BMW, taking Apple Stores as its model, has been installing “product geniuses” in some larger showrooms, to talk potential buyers through its cars’ features without pressing them to close a sale. Daimler Benz, another German premium carmaker, and even Kia, a mass-market South Korean firm, have begun similar initiatives.

Apple’s softer sell, which stresses its products’ design and whizzy features, helps to persuade customers to pay premium prices. Its selling methods have also succeeded in training customers to accept that the list price is the final price. In contrast, the motor industry has spent more than a century training buyers to expect haggling, followed by discounts. Yet customers say having to argue about the price is one of the things that puts them off dealers. Some firms are offering them ways to avoid it. Costco, a discount retailer, sold 400,000 new and used cars in America last year, using its buying power to get good deals, doing the haggling on behalf of motorists. Lexus, Toyota’s premium brand, is experimenting with haggle-free pricing in a handful of its American dealerships.

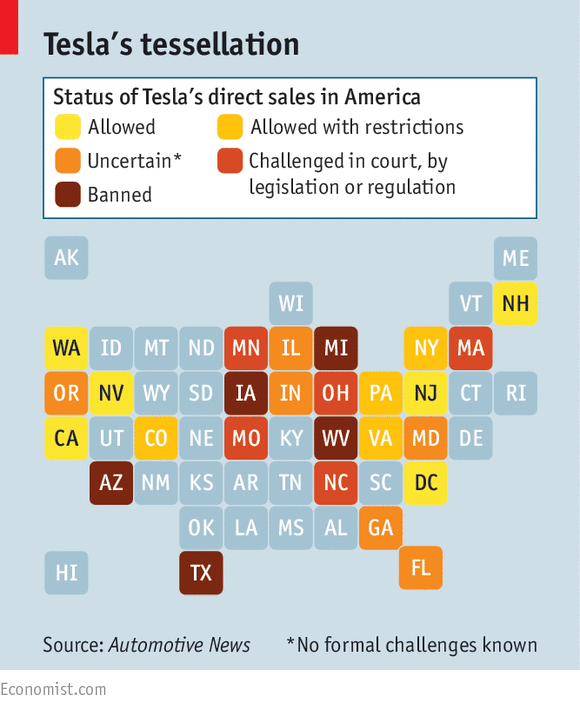

Some dealers are experimenting with selling cars online, or opening temporary “pop-up” showrooms in shopping centres. Others are offering to bring cars to a potential buyer’s home or workplace for a test drive. But the most controversial experiment is the one that Tesla, a maker of expensive electric cars, is trying: cutting out the dealers altogether and selling directly to motorists. Two decades ago Ford and General Motors tried to revive this idea from the industry’s early days, but they were deterred by resistant dealers and restrictive laws in some American states. The legislation, enacted in the 1950s to protect dealers from onerous terms that carmakers were trying to impose on them, is now being used to put the brakes on Tesla. It has battled to open stores in several states where direct sales are banned or restricted (see diagram). And it is winning most of its fights. New Jersey and Maryland recently overturned bans, though the struggle continues in Arizona, Michigan, Texas, and West Virginia.

In other countries, although carmakers face no legal hurdle to selling directly, they certainly would face resistance from their dealer networks. Nonetheless, Hyundai, Daimler Benz, BMW and Volvo have set up small experiments in Europe to sell cars through their company websites. Customers can use the sites to configure their new cars and pay a deposit. Volvo sold all 1,900 of a special version of a sports-utility vehicle it offered online last year, and it now wants to get its entire line-up for sale online by 2016. Daimler is mulling an expansion of pilot schemes in Hamburg and Warsaw. GM’s premium Cadillac brand plans to open several test-drive centres and virtual dealerships across Europe.

In all these cases except that of Tesla, the final stage of the transaction is handled offline, by a dealer. Even so, such selling methods strengthen customers’ relationships with carmakers, so they may steadily weaken the case for having dealers. This trend is set to be reinforced anyway, since most new cars will soon come with built-in mobile-internet connections that, among other things, will stream data directly to the manufacturer. By offering motorists such things as remote diagnostics and automatic updates to the software installed in their cars, the makers will have a ready-made excuse to stay in touch.

If carmakers did eventually cut out the middlemen, it could mean higher profits for them, lower prices for buyers, or both. Daron Gifford of Plante Moran, a consulting firm, notes that the potential savings could run from a few hundred to a few thousand dollars per car. Since mass-market carmakers’ margins are so slim, it could have a striking effect on their profitability.

Aside from the prospect of capturing the retail margin, and building direct links with buyers, carmakers’ shareholders have another reason to support the idea of eliminating dealers. That is because many manufacturers have got into the bad habit of overproducing, and of using dealers’ forecourts as dumping-grounds for their excess stock. In the trade it is called “channel-stuffing”: manufacturers twist dealers’ arms to take on their surplus cars, with a combination of juicy discounts and the threat of holding back more sought-after models. If cars were sold directly by the maker, and production were constantly tailored to match sales, the industry’s fortunes could be transformed.

Dealers, predictably, are desperate to remain the source of new cars even though they often make little or no money flogging them. In Britain, typically two-thirds of revenues but less than a quarter of profits come from that part of the business. However, selling new cars is the engine that drives the rest of their business—finance, insurance, warranties and other aftermarket products. Buyers often bring their cars back for repairs and servicing. Trade-ins provide dealers with a stock of used cars, another important source of income. In America, such ancillaries helped dealers survive in the six years to 2011, when they were selling new cars at a loss.

Online firms are replicating these services and chipping away at dealers’ local monopolies. Websites such as Edmunds and TrueCar in America, Carwow in Britain and Mobile.de in Germany let buyers quickly gather quotes from multiple dealers. Likewise, cheap insurance, finance and warranties are easy to find online. Motorists may get a better price for their old cars from a site like webuyanycar.com in Britain than by doing a trade-in with a dealer.

But just as some tourists still like to buy package holidays, there may always be some motorists who prefer a one-stop-shop that provides everything, and some who prefer to buy face-to-face rather than over the internet. America’s National Automobile Dealers’ Association puts forward two other reasons why motorists are better off with things the way they are. First, it argues, the competition among dealers to sell any given model helps to keep the retail profit margin low—and if carmakers captured the retail margin for themselves, there is no guarantee that any of it would be passed on to customers. Second, when a model has to be recalled because of a safety problem, dealers have an incentive to contact owners of that model promptly, since they usually get paid by the carmaker to correct the fault.

In America especially, car dealers are a forceful lobby, and unlikely to remain silent if carmakers try cutting them out of the picture. But their grip on the industry is loosening. The all-purpose dealership, encompassing sales of new and used cars, finance, insurance, servicing and parts, once made sense. Now this business model is being squeezed. If car buyers take to online buying in large numbers, it may not be long before a mass-market carmaker follows Tesla’s lead and tries to muscle aside the dealers. If customers are happy to buy direct from the manufacturer, lawmakers certainly should not stand in their way.

0 comments:

Post a Comment