You may not like what Zillow reports and you may well disagree with their estimates - after all, homeowners tend to remember the highest value anyone ever told them their home was worth and then assume forever that that is its 'true' worth. Buyers, meanwhile always believe that the values are overstated and that whatever dwelling interests them can be had for less if they just low-ball an estimate and wait for the seller to cave.

What is interesting is the degree to which the intangible online world is defining the sales of such tangible - and expensive items as homes, generally the largest financial asset that any individual is likely to own.

There are, of course, web-centric markets for everything, but in many cases such as autos, the service seems to be primarily informational rather than transactional. Zillow, by contrast, both identifies and sets the parameters of the market for residential real estate.It does so through the aggregation of comprehensive and comparable data.

But, as the following article explains, that dominance is dependent to some degree on its ability to master search engine optimization, especially with Google. The challenge - and the risk to both Zillow and those who depend on it - is that Google is beholden to no one and is known for sometimes rapid changes to its algorithms. It has been and might again be a competitor in the real estate space. All of which is to say that there is a lot of money riding on an ephemeral set of calculations and assumptions. JL

Rohin Dhar reports in Price Economics:

A very critical driver of Zillow’s business model continues be how well they dominate the Google search results. And that puts Zillow in the position of being reliant on a company that routinely changes the rules of the game.

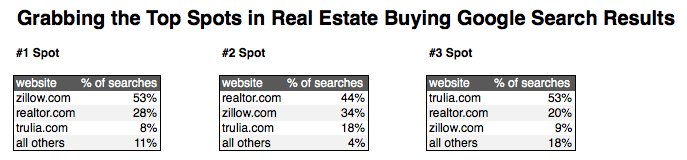

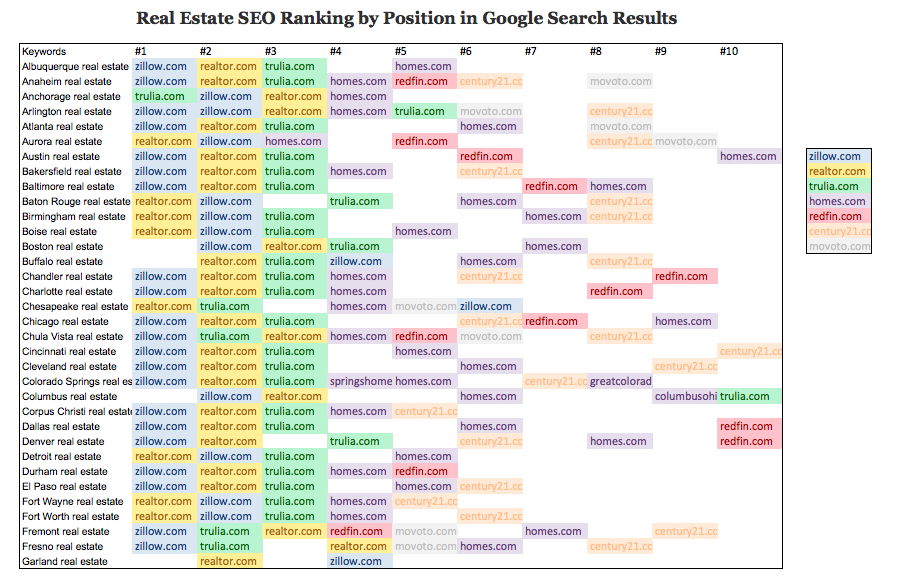

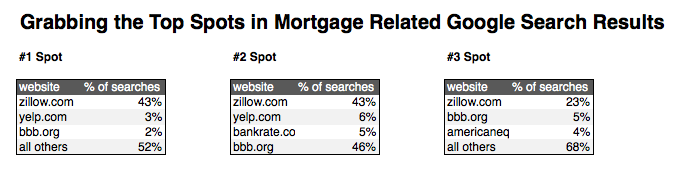

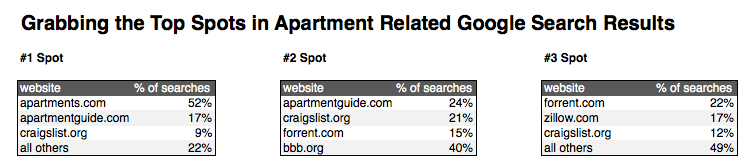

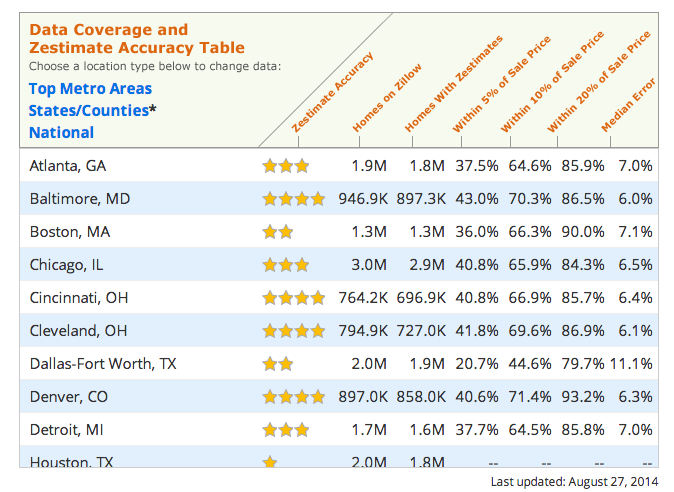

Buying a home is a big purchase. In the United States this September, homes sold for an average price of $313,000. A mortgage on that typical house will generate hundreds of thousands of dollars ininterest payments over the course of a thirty-year loan. The six percent commission to the real estate agents will be around $19,000. The title and escrow company will make about couple thousand dollars handling the transaction. The home inspector will charge about $300. The appraiser will charge another $300.This is to say: There is money to be made inreal estate transactions . One company that is well aware of this is Zillow, the most valuable consumer real estate technology company. The publicly traded company, valued at $4.2BN, generated $257 MM in revenues over the last twelve months, and grew quarterly revenue 66% year-over-year. Moreover, they are now in the process of acquiring their largest competitor, Trulia, in a multibillion dollar all-stock deal.Zillow’s business model is straightforward: They connect people looking to buy houses with the real estate agents,mortgage lenders , and advertisers who want to reach them. This most recent quarter, 74% of Zillow’s revenue comes from fees agents pay for customer leads and apartment leads, 8% comes from fees banks pay for mortgage leads, and 18% comes from advertising. They’ve also recently started connecting renters with apartment listings, and homeowners with design ideas and contractors.In order to make their business model work, Zillow needs to attract visitors to their site who are interested in buying houses. Google is a huge source for this kind of traffic, as millions of people make their purchase intent known everyday by typing searches like "buy a new house" into the search engine.Since Priceonomics Data Services analyzes SEO (search engine optimization) risk of publicly traded companies for our hedge fund customers, we though we'd take a look at how well Zillow ranks for real estate related keywords.The answer: Zillow does very very well in ranking at the top of Google for some extraordinarily lucrative keyword searches.The DataZillow does not disclose the amount of traffic they receive from Google, which is a shame because it’s likely a metric that would help investors to assess the company. When asked, a Zillow representative said they don’t make this number available for “competitive reasons.”We decided to look at the top 100 real estate markets in the United States, and see how the Zillow does in three subcategories related to: 1) home buying, 2)mortgage lending , and 3) apartment hunting. Our index of search terms included entries like: “Atlanta real estate”, “Atlanta mortgage”, “Atlanta apartments.” We derived these terms by looking at the webpage titles used by Zillow and competitors to approximate the kind of searches they’re targeting.For the general, home-buying keywords (e.g. “Atlanta real estate”), Zillow.com ranks first 53% of the time, walloping their nearest competitor Realtor.com, as well as the third place company, Trulia (which Zillow is in the process of acquiring).Source: Priceonomics Data ServicesIn addition to ranking first in the search results 53% of the time, another 34% of the time they rank second. In the below table, you visualize Zillow's dominance at the top of Google search results, especially when you consider they are about to acquire Trulia.Source: Priceonomics Data ServicesRanking first for this kind of keyword is very valuable. If you were to buy a Google text ad, and one user clicked through to your site, it would cost around $3-5 according to the Google Adwords planning tool.But the mortgage market is even more lucrative. The commissions on originating a loan can be around $1000, according to one broker we spoke with. This results in companies bidding a lot of moneyfor mortgage leads (buyinga mortgage -related Google Ad can cost around $20 per visit). Being the organic top-ranking position for these searches (e.g. “Atlanta mortgage”) is a great place to be because you get this valuable traffic for free.For mortgage keywords in our index, Zillow ranks first 43% of the time, trouncing the second place company which only ranks in the top spot for 3% of searches. Zillow equally dominates the 2 & 3 position as well.Source: Priceonomics Data ServicesFinally, we turn our attention to apartment rental searches (e.g. “Atlanta apartments”), a newish initiative for Zillow.Here, Zillow does not rank as well, as the top positions which are dominated by Apartments.com and ApartmentGuide. This presumably explains why these are successful companies that no one you know actively uses.Why is Zillow so great at SEO?Why is Zillow is good at SEO? Much of it is well-deserved: They assemble great data about housing prices and mortgage rates that people want to find through search engines. And as Tren Griffen notes, the “controversial/interesting metadata” they produce generates brand impressions for Zillow in the media and inbound links, which improves SEO rankings.Zource: Zillow "Zestimates"But what’s the SEO risk for Zillow? As we’ve seen with the case with the rise and fall of Retailmenot, the Google algorithm is inherently unpredictable. Moreover, some competitors like Redfin could one day assemble better data then Zillow because they have on the ground coverage and better data access through their network of real estate agents.Or Google could simply figure out how to insert their own results more prominently in their organic results. The company tried this in the past with the now-shuttered Google Real Estate Search, as well a mortgage comparison advertising product (also shut down).ConclusionZillow dominates SEO in the real estate space. How much of their traffic comes from Google is unknown to anyone outside the company, because they choose not to report it (despite it being an important metric for investors). Alexa estimates that Zillow gets about 22% of their traffic from search engines. In Zillow’s financial reports, they state “The majority of our traffic comes direct, not dependent on search engines, with demonstrated consumer intent to visit the Zillow brand”, a fairly difficult statement to parse.With the exception of apartment rental search, Zillow can’t really do any better at dominating Google’s World Wide Web, Now, the next frontier is wining in Apple and Google’s App Stores.It seems only a matter of time before most internet traffic is mobile. The good news is that, as Benchmark Capital VC (and Zillow Board member) Bill Gurley observes, in mobile, SEO isn't currently as important as on the web. Therefore, you can build a product experience for an actual customer instead of a Google web crawler, resulting in a better product. And as Gurley notes, it might be a landgrab to get real estate on someone’s home screen, but once you get there, you can have a much more loyal customers then a drive-by Google user.But until the web is good and dead, a very critical driver of Zillow’s business model continues be how well they dominate the Google search results. And that puts Zillow in the position of being reliant on a company that routinely changes the rules of the game.

1 comments:

dallas love airport car rental, van rental west palm beach van rental west palm beach car rental heathrow airport

Post a Comment